Octa has gained significant traction in Pakistan as a user-friendly forex and CFD broker with a strong mobile-first approach. By prioritizing local deposit methods like JazzCash and Easypaisa, Octa removes the usual banking hurdles faced by many Pakistani traders. Combined with commission-free trading, promotional bonuses, and simple account types, Octa stands out as one of the more accessible platforms for retail traders across the country.

Key Features for Pakistani Traders

Octa’s appeal in Pakistan lies in its ability to provide a simple, low-barrier trading environment. With a platform that emphasizes mobile usability, regional campaigns, and local payment options, Octa has clearly adapted its services to meet the specific needs of Pakistani traders—especially those just entering the forex market.

Regulation and Safety

Octa is registered under Octa Markets Incorporated and operates under the jurisdiction of St. Vincent and the Grenadines. While it does not hold licenses from major regulatory bodies like CySEC or FCA, the broker follows internal fund security protocols such as:

- Negative balance protection

- Segregated accounts

- 2FA and SSL encryption

While regulation may not match Tier-1 brokers, Octa’s local credibility and popularity in Pakistan are strengthened by its reliable withdrawal processing and transparent bonus terms.

Account Types and Trading Conditions

Octa simplifies trading with just one main account type, available with either fixed or floating spreads, depending on user preference. All accounts are commission-free, and traders can access leverage up to 1:500, ideal for managing smaller capital efficiently.

| Feature | Details |

|---|---|

| Minimum Deposit | $25 (or PKR equivalent) |

| Spreads | Fixed or Floating |

| Commission | None |

| Leverage | Up to 1:500 |

| Platforms | MT4, MT5 |

| Base Currencies | USD, EUR |

Local Payment Methods in Pakistan

One of Octa’s strongest advantages in the local market is its seamless integration with Pakistani payment solutions, allowing users to deposit and withdraw funds without needing international bank accounts or e-wallets.

Supported local methods include:

- JazzCash

- Easypaisa

- Bank Transfer (via regional partners)

All transactions are processed in PKR, which eliminates conversion fees and simplifies account funding for everyday users.

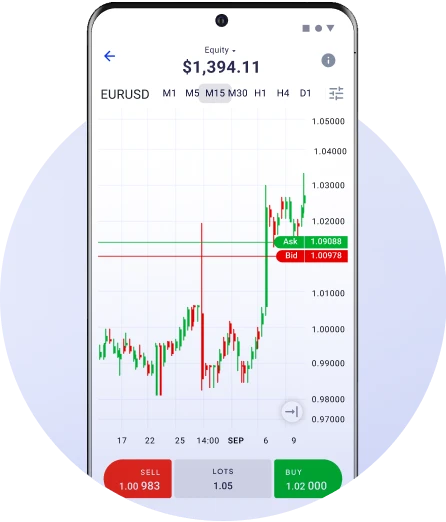

Trading Platforms

Octa supports the industry standards:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

While this covers most of the functionality that retail traders need, it’s important to note that Octa does not offer any additional third-party or proprietary platforms. Traders looking for advanced analytics, APIs, or desktop-native multi-platform tools may find this limiting.

However, for mobile users, Octa’s own app provides a smooth experience with full trading, deposit, and withdrawal capabilities.

Educational Content and Bonus Offers

Octa regularly runs regional promotions, including:

- Deposit bonuses

- Trading contests

- Loyalty rewards for active users

Additionally, the broker offers basic educational material, covering:

- Forex trading basics

- Platform tutorials

- Webinars (occasionally in Urdu)

Although not as extensive as global brokers with academies, this content is suitable for beginners in Pakistan.

Pros and Cons of Octa for Pakistan

Pros

- Easy funding via JazzCash, Easypaisa, and local bank transfer

- No trading commissions

- Promotions and bonuses tailored to Pakistani users

- Mobile-friendly interface and dedicated app

Cons

- Limited asset offering (mostly forex, metals, and crypto)

- No additional platforms beyond MT4 and MT5

- Unregulated by top-tier authorities

Is Octa a Good Choice for Pakistani Traders?

Octa is well-suited to new and intermediate-level traders in Pakistan who value convenience, simplicity, and local payment accessibility. While it lacks advanced tools or multi-platform support, its zero-commission structure, PKR funding, and localized bonus campaigns make it a practical choice for those looking to get started in the global forex market with minimal barriers.

For those seeking a more advanced infrastructure or institutional-level security, regulated brokers like FXTM or IC Markets may offer better alternatives—but with higher entry thresholds and fewer local perks.