FBS is a globally recognized forex and CFD broker that has built a solid reputation in Pakistan for its accessibility, localized features, and low entry barrier. Whether you’re a beginner testing strategies or a trader looking to scale with small capital, FBS stands out with its $1 minimum deposit, cent accounts, and support for Easypaisa and JazzCash—popular local payment methods in Pakistan.

With its strong presence in Asia and multilingual support (including Urdu-language content), FBS caters directly to the needs of the Pakistani trading community. It is regulated by IFSC (Belize) and CySEC (Cyprus), offering both offshore flexibility and some EU-standard protections depending on the entity chosen.

Key Features of FBS for Pakistani Traders

FBS has tailored its services to align with the practical needs and preferences of traders in Pakistan. From enabling seamless deposits via local payment systems to offering account types suitable for both beginners and experienced traders, the broker focuses on reducing entry barriers while ensuring essential tools are available. Its support for Urdu content and Shariah-compliant trading further strengthens its appeal in the local market.

Ultra-Low Deposit Requirement

- Minimum deposit starts from just $1 for cent accounts, making it ideal for new traders or those wishing to minimize risk.

- Enables testing real trading conditions without committing significant capital.

Localized Payment Options

- Fully supports Easypaisa and JazzCash, two of Pakistan’s most widely used mobile payment systems.

- Also accepts local bank transfers, making deposits and withdrawals smoother and faster.

Cent and Micro Accounts

- Cent accounts allow traders to operate in cents rather than dollars. For instance, a $10 deposit becomes 1,000 cents.

- Perfect for learning with real money while maintaining low exposure.

- Micro accounts are also available for precise position sizing and better risk management.

Urdu Language Support

- FBS provides a fully localized Urdu version of its website and customer support materials.

- This is a significant advantage for Pakistani traders who prefer learning and navigating platforms in their native language.

Regular Bonuses and Promotions

- Frequent deposit bonuses, cashback, and trading contests are offered.

- While appealing, these come with specific terms and trading volume requirements.

Account Types Offered

FBS provides a flexible range of account types designed to accommodate traders at different skill levels and investment capacities. Whether you’re just starting with a small budget or scaling up to higher volumes and advanced strategies, there’s an account option to match your needs. Each account type differs in terms of spreads, commission structure, minimum deposits, and execution model, allowing Pakistani traders to choose what aligns best with their goals and risk appetite.

| Account Type | Min Deposit | Spreads | Commission | Ideal For |

|---|---|---|---|---|

| Cent Account | $1 | From 1 pip | None | Beginners, strategy testing |

| Standard Account | $100 | From 0.5 pips | None | Intermediate traders |

| Zero Spread Account | $500 | 0.0 pips fixed | $20 per lot | Scalpers, day traders |

| ECN Account | $1000 | From -1 pip | $6 per lot | Professional traders |

Pros and Cons

While FBS offers several advantages that cater specifically to the Pakistani market—such as local deposit options, cent accounts, and Urdu-language support—it also comes with certain limitations that traders should evaluate carefully. Understanding both the strengths and drawbacks of the broker will help you make an informed decision based on your trading style, capital, and experience level.

Pros

- Ultra-low deposit options starting at $1.

- Supports Easypaisa and JazzCash, easing the funding process.

- Cent accounts suitable for learning with real money.

- Local language support via Urdu.

- Leverage up to 1:3000 for non-EU clients (use with caution).

- MetaTrader 4 & 5 support, plus a proprietary FBS app.

Cons

- Spreads on standard and cent accounts can be wider than ECN counterparts.

- Bonus conditions often require high trading volumes before withdrawal.

- Offshore regulation (IFSC) may not provide the same protections as top-tier EU regulators.

- Limited educational materials compared to top-tier brokers.

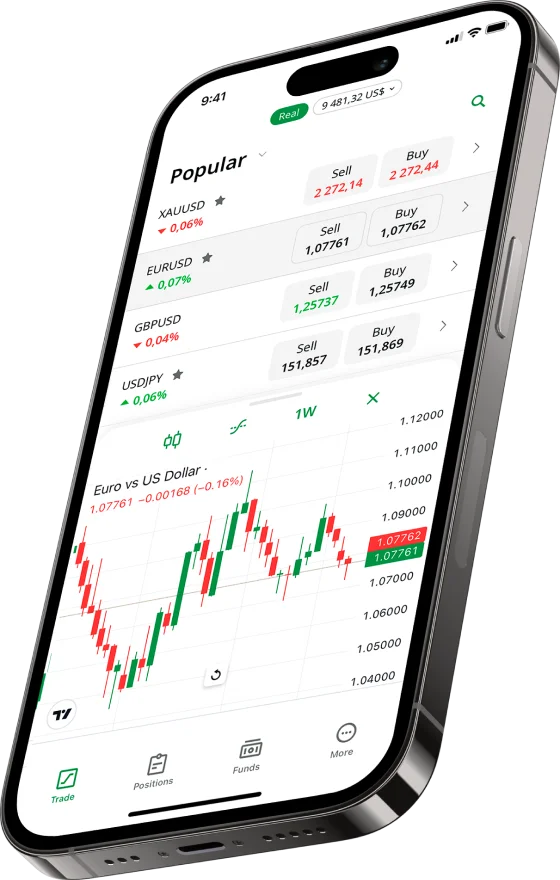

Trading Platforms and Tools

FBS offers:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms

- FBS Trader App (user-friendly mobile trading)

- VPS services for automated trading

- Economic calendar, forex calculator, and daily analysis tools

Pakistani traders who prefer mobile access will find the FBS Trader app convenient, especially since it integrates deposits via JazzCash and Easypaisa directly.

Customer Support in Pakistan

FBS offers localized and multilingual customer support tailored to Pakistani traders, aiming to resolve issues quickly and in the preferred language.

- Urdu-language email and live chat

- Social media presence with Pakistani-specific promotions

- Response times are generally quick (under 5 minutes during business hours)