Tickmill is a globally respected ECN-style broker best suited for experienced traders who prefer precision, speed, and transparent pricing. Established in 2014, Tickmill operates under strong regulatory oversight from FCA (UK), CySEC (Cyprus), and FSA (Seychelles), ensuring safety and compliance for international clients.

Although it doesn’t directly target the Pakistani market, its professional-grade trading environment, tight spreads, and low latency execution make it attractive for advanced traders in Pakistan who operate with international bank cards or e-wallets.

Why Tickmill Appeals to Advanced Pakistani Traders

Tickmill is designed for serious traders, particularly scalpers, day traders, and algorithmic traders, who benefit from its raw spread accounts and commission-based structure. The broker’s ECN model allows access to deep liquidity, meaning trades are executed quickly with minimal slippage.

Pakistani traders using international funding methods appreciate Tickmill for its transparency and reliability, although the absence of local language or banking support limits accessibility for beginners.

In short, Tickmill appeals most to those who already understand global trading environments and value institutional-grade conditions.

Trading Accounts and Platforms

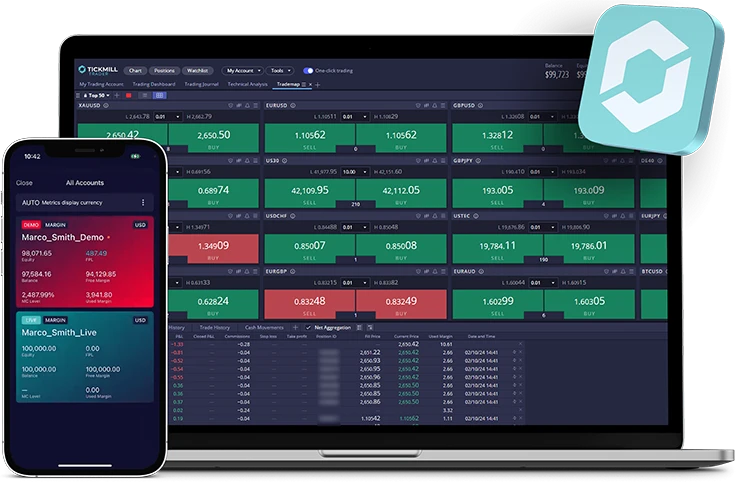

Tickmill offers several account types designed for different trader profiles:

- Classic Account: No commissions, spreads from 1.6 pips, suitable for casual traders.

- Pro Account: Spreads from 0.0 pips with a commission of $2 per side per lot, ideal for scalpers.

- VIP Account: For high-volume traders, offering the lowest commissions and premium execution.

All accounts support MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both known for stability, charting tools, and Expert Advisor (EA) compatibility.

Tickmill also provides VPS hosting, enabling high-speed automated trading with minimal downtime — a crucial advantage for algorithmic and high-frequency traders.

Spreads, Fees, and Execution

One of Tickmill’s main attractions is its tight spreads, starting from 0.0 pips on Pro and VIP accounts. The broker operates a commission-based ECN model, ensuring traders always get transparent pricing with no dealing desk interference.

Execution speeds are extremely fast, with average order execution times below 0.2 seconds, which is especially beneficial for scalping and news trading strategies.

The combination of low spreads, fast execution, and no requotes has made Tickmill a preferred choice for professional traders globally.

Deposits, Withdrawals, and Accessibility in Pakistan

Tickmill supports global payment systems, including Visa/MasterCard, Skrill, Neteller, and bank transfers. However, local Pakistani payment methods and currency deposits (PKR) are not available.

This means traders in Pakistan must use international cards or e-wallets, which might involve currency conversion fees. The minimum deposit requirement for Pro accounts is higher compared to other brokers, which could deter beginners with smaller budgets.

Despite this, withdrawals are processed efficiently, often within 24 hours, and Tickmill covers transaction fees for several international payment options.

Education and Support

Tickmill provides an excellent education portal featuring webinars, e-books, tutorials, and market analysis. However, these resources are mainly available in English and other major languages — Urdu support is not yet offered.

Customer service operates 24/5 via live chat and email, known for professionalism and responsiveness, though the absence of localized support can be challenging for traders new to international platforms.

Pros and Cons of Tickmill for Pakistani Traders

Pros:

- Tight spreads starting from 0.0 pips

- Transparent pricing and ECN execution

- Strong regulatory framework under FCA, CySEC, and FSA

- Fast trade execution and VPS hosting for automation

Cons:

- High initial deposit for Pro and VIP accounts

- No local payment methods or Urdu support

- Not ideal for beginners due to advanced trading environment