ThinkMarkets is a globally recognized online broker known for its advanced trading technology, strong regulation, and focus on platform innovation. Founded in 2010, the broker operates under the supervision of top-tier regulators such as the FCA (UK) and ASIC (Australia), ensuring transparency, safety, and fair trading conditions.

Although local banking options in Pakistan are not available, ThinkMarkets continues to attract Pakistani traders who seek reliable execution, powerful tools, and access to global markets.

Why ThinkMarkets Appeals to Pakistani Traders

ThinkMarkets stands out for its technology-driven approach, combining multiple trading platforms with low-latency order execution. It is especially suitable for traders who prioritize speed, mobile access, and data-driven strategies.

While the broker does not offer Urdu-language content or local deposit methods, it remains popular among experienced Pakistani traders who use international bank cards or e-wallets for funding.

Its proprietary ThinkTrader app, available on desktop and mobile, delivers institutional-level analytics, making it ideal for those who want flexibility and high-end functionality in one platform.

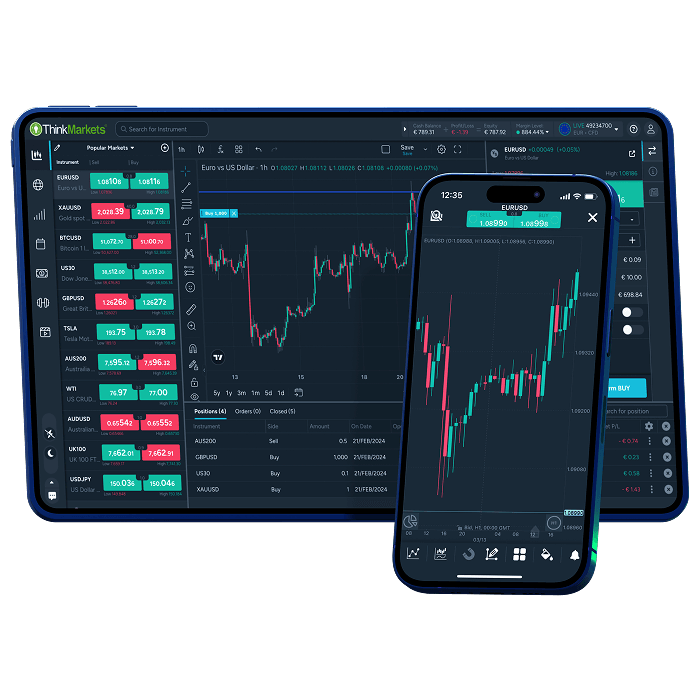

Trading Platforms: ThinkTrader, MT4, and MT5

ThinkMarkets offers three main trading platforms, ensuring versatility for all trading styles:

- ThinkTrader (Proprietary Platform):

The broker’s flagship platform, ThinkTrader, provides a modern interface, advanced charting tools, multi-device syncing, and over 80 indicators. It supports cloud-based alerts, AI-driven risk management, and fast order execution, making it perfect for traders who value technology and mobility. - MetaTrader 4 (MT4):

A classic choice for forex traders, offering Expert Advisor (EA) support, automated strategies, and robust technical analysis tools. - MetaTrader 5 (MT5):

The next-generation platform with improved execution speed, more timeframes, and built-in market depth, ideal for multi-asset trading and complex strategies.

Together, these platforms give traders in Pakistan flexibility and scalability, whether they prefer traditional MT4/MT5 environments or ThinkMarkets’ proprietary solution.

Trading Instruments and Market Access

ThinkMarkets provides access to a diverse selection of global financial instruments, including:

- Forex: 40+ major, minor, and exotic currency pairs.

- Commodities: Trade oil, gold, and agricultural products.

- Indices: Exposure to global indices like NASDAQ, S&P 500, and FTSE 100.

- Shares and ETFs: Access to international stock markets.

- Cryptocurrencies: Trade leading digital assets via CFDs.

This wide range allows Pakistani traders to diversify portfolios and trade multiple asset classes from a single account.

Account Types and Trading Conditions

ThinkMarkets offers two primary account types designed for different trading preferences:

- Standard Account:

No commission, spreads starting from 0.4 pips, and suitable for casual or intermediate traders. - ThinkZero Account:

ECN-style account with spreads from 0.0 pips and a $3.5 commission per side, designed for scalpers and professionals seeking tight spreads and direct market access.

While the broker’s minimum deposit is higher than average — $500 for ThinkZero accounts — this requirement aligns with its premium trading infrastructure and advanced platform offerings.

Execution, Technology, and Security

ThinkMarkets prides itself on low-latency execution supported by Tier-1 liquidity providers and global data centers. Orders are executed in milliseconds, minimizing slippage even during high volatility.

The broker also prioritizes security, offering negative balance protection, segregated client funds, and strong encryption protocols. Its dual regulation under FCA and ASIC provides traders in Pakistan with additional confidence in the broker’s credibility and operational standards.

Deposits, Withdrawals, and Accessibility in Pakistan

Although ThinkMarkets does not currently support local Pakistani banking channels, traders can deposit and withdraw using international options such as:

- Visa and MasterCard

- Skrill

- Neteller

- Bank wire transfers

Deposits are generally processed instantly, while withdrawals are completed within 24 hours. Currency conversion fees may apply for PKR transactions, as all accounts operate in major global currencies (USD, EUR, GBP).

Education and Market Research

ThinkMarkets provides an extensive library of educational materials and market insights. Its resources include:

- Video tutorials and webinars

- E-books and strategy guides

- Daily market analysis and trading signals

The broker’s ThinkPortal delivers professional-grade analytics, including real-time data, news updates, and risk management tools. While content is primarily in English, it is comprehensive and valuable for both beginners and professionals.

Pros and Cons of ThinkMarkets for Pakistani Traders

Pros:

- Proprietary ThinkTrader platform with advanced tools

- Fast execution and low latency trading

- Regulated by FCA and ASIC, ensuring global trust

- Wide asset variety across forex, CFDs, and crypto

Cons:

- Higher minimum deposit compared to other brokers

- No localized content or Urdu support

- No local payment channels in Pakistan