AvaTrade stands among the most established names in the global trading industry, offering a combination of reliability, technology, and market accessibility. Founded in 2006, the broker is regulated in multiple jurisdictions, including the European Union, Japan, Australia, and South Africa. This multi-regional oversight gives Pakistani traders confidence in its transparency and operational standards — key factors when dealing with offshore brokers.

Trading Conditions and Platforms

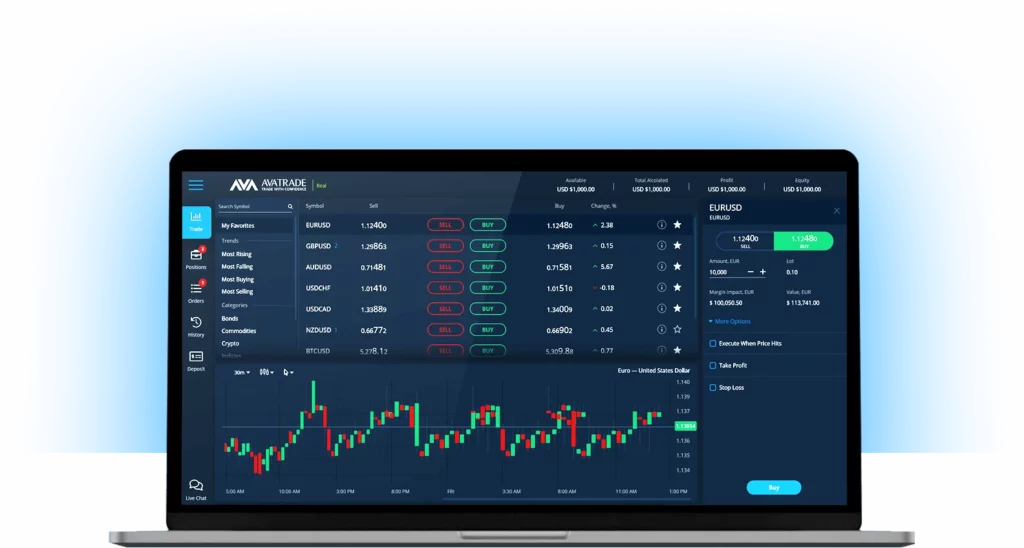

AvaTrade provides access to Forex, commodities, indices, stocks, ETFs, and cryptocurrencies through both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. What sets it apart is its AvaTradeGO app, a proprietary mobile platform designed to make position management and price monitoring intuitive and efficient. The app integrates real-time analytics, trend monitoring, and educational tools — valuable for traders looking to balance learning with execution.

AvaTrade also supports automated and copy trading through systems like DupliTrade and Zulutrade, enabling traders to mirror professional strategies. For those who prefer more predictable trading costs, the broker offers fixed spread accounts, which can be particularly useful during high-volatility sessions when variable spreads tend to widen.

Deposits, Withdrawals, and Accessibility in Pakistan

One drawback for traders in Pakistan is that AvaTrade does not currently support local payment gateways such as JazzCash or Easypaisa. Deposits and withdrawals are typically handled via international credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. While this might be inconvenient for those who prefer localized funding methods, the process remains secure and globally recognized.

Despite the absence of local payment integration, AvaTrade compensates through responsive multilingual support, including live chat and email, which are available around the clock. For traders in Pakistan, English-language assistance ensures communication remains clear and efficient.

Fees and Trading Costs

AvaTrade operates primarily with fixed spreads, giving traders consistent transaction costs regardless of market conditions. However, one area that requires caution is its inactivity fee, which is relatively high compared to other brokers. Accounts that remain idle for extended periods are charged a maintenance fee, which can accumulate over time if the trader does not engage regularly.

That said, AvaTrade does not charge commissions on most trades, making it a cost-effective choice for those who maintain consistent trading activity.

Regulation and Safety

The broker is regulated by several top-tier authorities, including:

- Central Bank of Ireland (CBI)

- Australian Securities and Investments Commission (ASIC)

- Japan’s Financial Services Agency (FSA)

- South Africa’s FSCA

This global compliance framework provides Pakistani traders with an added layer of security, ensuring that client funds are kept in segregated accounts and that trading operations adhere to international standards.

Pros and Cons

When evaluating AvaTrade from a Pakistani trader’s perspective, it’s clear that the broker offers a balanced mix of advantages and limitations. On one hand, its strong global regulation, access to automated trading tools, and availability of fixed spreads make it a dependable choice for those focused on consistency and safety. On the other hand, the lack of local payment gateways and the presence of inactivity fees can be challenging for traders who prefer flexible deposit options or trade less frequently. Understanding these points can help determine whether AvaTrade aligns with individual trading goals and activity levels.

Pros:

- Fixed spread accounts suitable for predictable cost management

- Regulated in multiple jurisdictions

- Supports copy trading via DupliTrade and Zulutrade

- Advanced proprietary mobile app (AvaTradeGO)

- Strong automation and analytics tools

Cons:

- No support for JazzCash or Easypaisa

- High inactivity and administration fees for dormant accounts