Admirals, formerly known as Admiral Markets, is a globally regulated online broker that offers a comprehensive trading environment covering forex, stocks, ETFs, indices, commodities, and CFDs. Founded in 2001, the broker has earned a strong reputation for its educational programs, powerful trading tools, and transparent pricing model.

While its presence in Pakistan is still limited, Admirals remains a popular choice among traders who seek diversified investment opportunities and institutional-grade market analysis.

Why Admirals Appeals to Pakistani Traders

Admirals is especially attractive to Pakistani traders looking for international market exposure beyond traditional forex trading. The broker allows clients to trade thousands of global stocks and ETFs, along with standard forex and CFD instruments.

Its multi-asset offering, combined with negative balance protection and advanced risk management tools, makes Admirals suitable for professional traders who value security and portfolio diversity.

Although it doesn’t yet offer Urdu-language support or local deposit methods, Pakistani traders who use international cards or e-wallets can still easily access its global trading ecosystem.

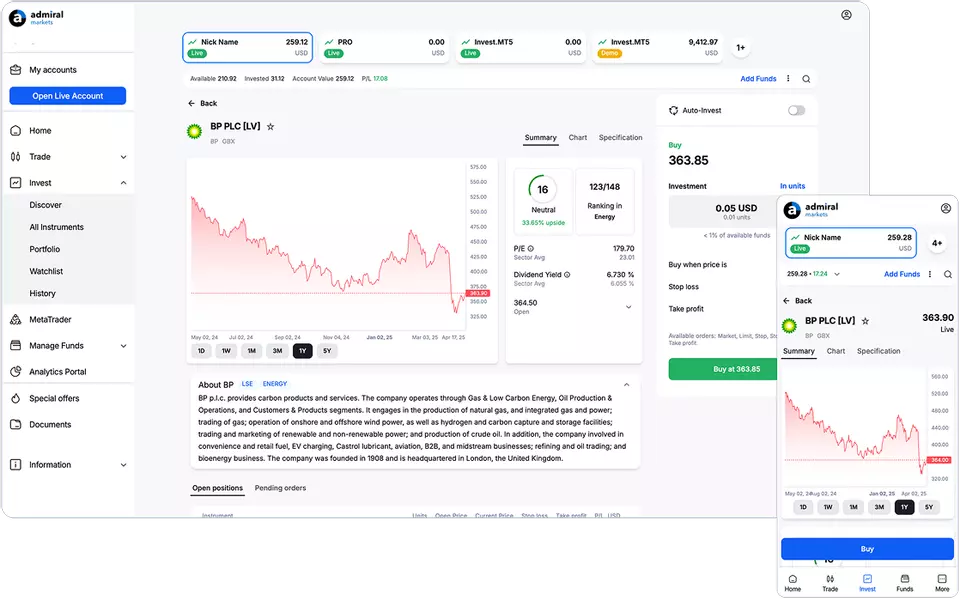

Trading Platforms and Tools

Admirals supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) — the industry’s most popular and trusted platforms. These platforms provide access to:

- Advanced charting tools

- Automated trading via Expert Advisors (EAs)

- One-click execution and customizable layouts

In addition, Admirals enhances these platforms with exclusive plugins like MetaTrader Supreme Edition, which includes tools such as:

- Advanced indicators and sentiment analysis

- Mini terminal for order management

- Real-time news and calendar integration

This makes Admirals an excellent choice for technical and analytical traders seeking an upgraded MetaTrader experience.

Market Instruments and Investment Options

Unlike many forex-only brokers, Admirals provides a diverse range of instruments across global markets, including:

- Forex: 40+ currency pairs with tight spreads and fast execution.

- Stocks & ETFs: Direct access to international equities and exchange-traded funds.

- Indices & Commodities: Trade major global indices and commodities like gold, oil, and silver.

- Cryptocurrencies: Available as CFDs for flexible digital asset exposure.

This broad selection allows traders in Pakistan to build diversified portfolios and gain exposure to multiple markets through a single trading account.

Account Types and Trading Conditions

Admirals offers several account options suitable for different trader profiles:

- Trade.MT4 / Trade.MT5: Ideal for CFD traders who prefer forex and metals.

- Zero.MT4 / Zero.MT5: ECN-style accounts with spreads from 0.0 pips and small commissions.

- Invest.MT5: Designed for long-term investors trading real stocks and ETFs.

All accounts offer negative balance protection, leverage up to 1:500, and transparent pricing with no hidden fees. Execution is fast and reliable, backed by Tier-1 liquidity providers.

Deposits, Withdrawals, and Local Accessibility

Admirals supports global payment methods, including Visa/MasterCard, Skrill, Neteller, and bank transfers. However, it currently does not support local Pakistani payment systems such as Easypaisa or JazzCash.

Deposits are typically processed instantly via e-wallets, while withdrawals are completed within one business day. Although currency conversions may apply for PKR-based traders, Admirals ensures secure and efficient transactions through its global banking network.

Education and Market Analysis

One of Admirals’ strongest features is its educational ecosystem. The broker provides a vast library of webinars, e-books, articles, podcasts, and market analysis, helping traders improve their skills and decision-making.

Its Analytics Portal and Trading Central integration offer:

- Economic calendars

- Market sentiment tools

- Technical analysis signals

- Expert insights and trading ideas

While Urdu-language content is not yet available, English resources are comprehensive and regularly updated, making Admirals one of the most informative brokers globally.

Pros and Cons of Admirals for Pakistani Traders

Pros:

- Investment options beyond forex, including stocks and ETFs

- Negative balance protection for safer trading

- Strong market research and educational tools

- Regulated by top-tier authorities (FCA, CySEC, ASIC)

Cons:

- No Urdu-language support or local Pakistani payment methods

- Not ideal for complete beginners due to advanced tools and complex features